A robust insurance claim management system, characterized by user-friendly interfaces, real-time updates, and seamless communication, smoothly processes claims from submission to settlement, benefiting both providers and policyholders. Key elements include structured intake and documentation processes, digital tools for automated data entry and tracking, and collaborative efforts between insured individuals, insurers, and repair shops. Technological advancements, such as automated systems and advanced imaging techniques, have significantly transformed claim management in the digital age, enhancing efficiency, transparency, and policyholder satisfaction.

“Uncover the secrets to efficient and effective insurance claim management systems. This comprehensive guide reveals seven key strategies that drive success in an industry where timely, accurate processing is paramount. From understanding core components and leveraging technology to enhancing customer experiences through data-driven insights, each section provides valuable insights. Discover how automation streamlines processes, improving accuracy and customer satisfaction, while exploring best practices that foster transparent communication and personalized claim handling.”

- Understanding the Core Components of a Successful Insurance Claim Management System

- – Defining key elements for efficient claim processing

- – The role of technology in modern insurance claim management

Understanding the Core Components of a Successful Insurance Claim Management System

A robust insurance claim management system is akin to a well-oiled machine, where each component plays a crucial role in ensuring smooth operations and customer satisfaction. At its heart, such a system comprises several key elements that work in harmony to streamline the process from initial claim filing to final settlement. Understanding these core components is essential for both insurance providers and policyholders alike.

First and foremost, an efficient system must offer a user-friendly interface for claim submission and tracking. This enables policyholders to quickly report incidents, such as car collisions or damage to their vehicles, through digital platforms. Additionally, real-time updates on claim status, including progress in car collision repair or frame straightening, empower customers with transparency. Integrating features for seamless communication between stakeholders, like agents and assessors, further enhances the overall efficiency of managing car bodywork claims.

– Defining key elements for efficient claim processing

Efficient insurance claim management requires a structured approach with clearly defined key elements. The first step involves establishing robust processes for claim intake and documentation. This includes streamlined procedures for collecting and verifying customer information, incident details, and supporting evidence such as photos and reports from auto collision centers or tire services. A well-organized system ensures that no crucial data is overlooked during the initial stages of claim processing.

Additionally, integrating digital tools for automated data entry, claims tracking, and communication channels enhances efficiency. Collaboration between insured individuals, insurance providers, and collision repair shops is vital. Seamless coordination enables faster decision-making, reduces paperwork, and ultimately speeds up compensation for damages, whether it’s for a minor fender bender or more significant collision repairs.

– The role of technology in modern insurance claim management

In today’s digital era, technology has revolutionized insurance claim management systems, making processes more efficient and streamlined. Automated systems enable faster handling of claims, from initial reporting to assessment and settlement. Digital platforms facilitate real-time updates, ensuring all stakeholders have access to the latest information. This not only reduces administrative burdens but also enhances transparency for policyholders.

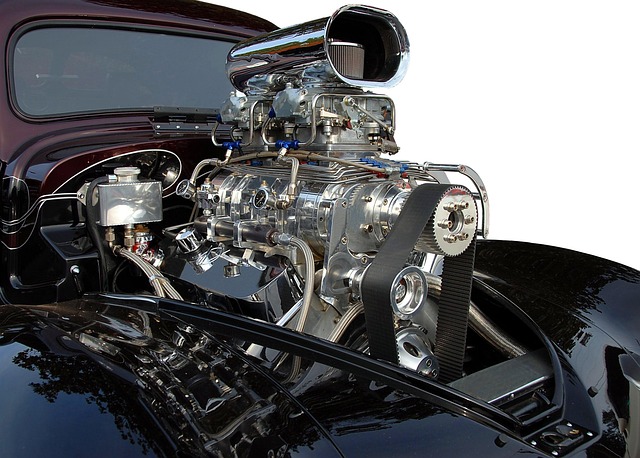

One notable area where technology has made significant strides is in assessing and approving car dent repair and auto painting claims. Advanced imaging techniques, such as 3D scanning, allow for precise measurements and visual documentation of damage, accurately determining the scope of work for auto collision repair. This precision leads to quicker claim approvals and more satisfactory outcomes for policyholders, be it for minor cosmetic issues or major structural repairs.

Effective insurance claim management systems are essential for streamlining processes, enhancing customer satisfaction, and reducing costs. By understanding the core components and leveraging technology, insurers can significantly improve their claim handling efficiency. Implementing these seven secrets not only simplifies complex procedures but also fosters trust and transparency, ultimately strengthening the relationship between insurers and policyholders.