Effective insurance claim management relies on understanding core processes for validity assessment and accurate compensation determinations. Clear communication via structured channels like regular updates or dedicated platforms minimizes confusion and speeds up repairs, enhancing customer satisfaction. Streamlined digital documentation and record-keeping facilitate smoother claim processing, empower adjusters to make quicker decisions, reduce turnaround times, and foster trust with clients.

Mastering insurance claim management is key to swift resolutions and accurate records. This guide delves into the best practices essential for efficient claim processing. First, grasp the fundamental steps of the claim management process. Next, explore effective communication strategies to enhance stakeholder engagement. Lastly, learn how to streamline documentation and record-keeping for better organization and compliance. Implement these practices to optimize your insurance claim management, ensuring fairness and efficiency throughout.

- Understand Basic Claim Management Process

- Implement Efficient Communication Strategies

- Streamline Documentation and Record Keeping

Understand Basic Claim Management Process

The foundation of effective insurance claim management lies in comprehending the core process involved. It begins when a policyholder initiates a claim, whether it’s for property damage like a vehicle dent repair or more complex car body repairs. The insurer then assesses the validity and extent of the claim, a crucial step that determines the subsequent actions. This initial evaluation can significantly impact the entire claim management journey.

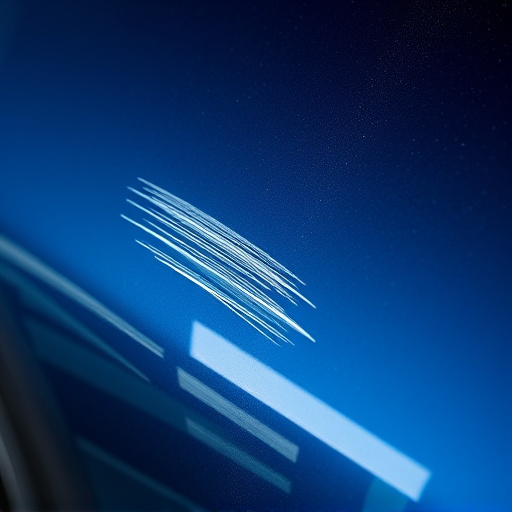

During this phase, insurance professionals consider various factors, such as gathering evidence (including photos for car dent removal scenarios), verifying details with the policyholder, and comparing it against the terms and conditions of the insurance policy. A thorough understanding of these procedures empowers insurers to streamline the process, ensuring a seamless experience for both parties while accurately determining compensation for repairs, be it minor scuffs or more extensive car body repairs.

Implement Efficient Communication Strategies

Insurers and claim handlers should strive for clear and timely communication when managing insurance claims, especially for complex cases involving vehicles that require a vehicle body shop for scratch repairs or collision damage repair. Establishing efficient channels early on sets the tone for a seamless process. A structured approach can include regular updates via email or dedicated platforms, ensuring all stakeholders—policyholders, repair centers, and underwriters—are aligned.

This strategy minimizes confusion and reduces the time typically spent on back-and-forth correspondence. By implementing robust communication methods, the insurance claim management process becomes more transparent, fostering trust between the insurer and the policyholder. Prompt and accurate information sharing is key to ensuring that repairs, such as those for scratch repairs or collision damage, are handled swiftly, leading to better customer satisfaction.

Streamline Documentation and Record Keeping

Efficient insurance claim management starts with streamlined documentation and record keeping. In the dynamic landscape of auto insurance claims, whether it’s for a car body shop repair due to hail damage or an extensive auto painting job, clear and organized records are paramount. Digital systems that integrate seamlessly with existing processes can significantly enhance this aspect. By implementing these best practices, you ensure that all relevant information is captured accurately and securely stored. This includes detailed descriptions of damages, before-and-after photographs, repair estimates, and communication logs with clients and stakeholders.

Well-organized documentation not only facilitates smoother claim processing but also serves as a robust reference point for future audits or disputes. It empowers adjusters to make informed decisions quickly, reducing turnaround times and enhancing customer satisfaction in the case of hail damage repair or any other complex auto painting scenarios. This, in turn, contributes to building trust with clients and maintaining a positive reputation in the insurance claim management industry.

By understanding the core processes, implementing clear communication strategies, and streamlining documentation, organizations can significantly enhance their insurance claim management practices. These best practices ensure efficient handling of claims, reduce costs, and foster stronger relationships with policyholders. Effective claim management is not just a process; it’s a competitive advantage in the insurance industry.