Provide detailed policyholder info, incident description, and supporting docs like photos and reports for accurate insurance claim management. Double-check contact details, policy numbers, dates, locations, and damage extent to avoid delays or denials. Maintain clear, structured documents with estimates, invoices, and communications to expedite claim approval.

Understanding the fundamentals of insurance claim documentation is crucial for seamless claim processing. This guide breaks down the essential components of insurance claim forms, emphasizing accurate information verification to ensure successful claim management. We explore common mistakes and provide actionable strategies to avoid them, empowering policyholders and professionals alike in navigating the intricacies of modern insurance claim management.

- Key Components of Insurance Claim Forms

- Verifying Information for Accurate Documentation

- Common Mistakes and How to Avoid Them

Key Components of Insurance Claim Forms

When completing an insurance claim form, several crucial components are essential for a seamless insurance claim management process. These include detailed information about the policyholder and their insurance policy, a comprehensive description of the incident or loss, and supporting documentation such as photographs, reports, and receipts. The policyholder’s contact details, policy number, and type of coverage should be accurately recorded to ensure proper processing by the insurance company.

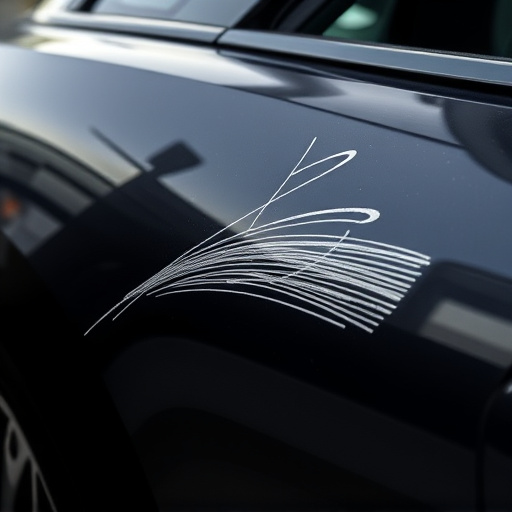

Additionally, specifying the nature of the claim is vital, whether it’s for an unexpected event like an automotive collision repair or a sudden illness. For vehicle-related claims, particularly for luxury vehicle repair, it’s important to provide the make, model, and year of the vehicle, along with details about the damage incurred. This enables insurance assessors to accurately estimate costs and find specialized providers like auto collision centers equipped to handle such repairs effectively.

Verifying Information for Accurate Documentation

Accurate insurance claim documentation hinges on verifying all relevant information. Before submitting a claim, it’s crucial to double-check details like dates, locations, and the extent of damages. In the case of car dent removal or collision repair, for instance, ensure you have clear photos documenting both the incident and the pre-existing condition of your vehicle. This reduces discrepancies later in the insurance claim management process.

Additionally, verify the accuracy of personal information such as names, contact details, and policy numbers. Incorrect data can delay processing, which is why regular review and cross-reference with your policy documents are essential practices for smooth auto maintenance and efficient insurance claim handling.

Common Mistakes and How to Avoid Them

Submitting an insurance claim can be a complex process, and mistakes during documentation can lead to delays or even claim denials. It’s crucial to understand what common errors to avoid, especially when dealing with auto body services or fleet repair services. One frequent mistake is incomplete or inaccurate information. Insurers rely on detailed, truthful claims, so always provide all relevant facts about the incident, including dates, locations, and any medical treatments received. Misrepresenting or omitting details can severely impact your claim’s success.

Another common pitfall is poor organization and formatting. Ensure your documents are well-structured, easy to read, and follow the insurer’s guidelines. For instance, when filing a claim for vehicle repair, keep records of all estimates, invoices, and communication with mechanics or garages. Clear documentation demonstrates your commitment to the process and makes it easier for insurance claim management teams to assess and approve your claim promptly.

Mastering insurance claim documentation is a vital step in efficient insurance claim management. By understanding the key components, verifying information accurately, and steering clear of common mistakes, individuals can ensure their claims are processed smoothly. This knowledge empowers folks to navigate the complexities of insurance claim forms confidently, ultimately leading to faster settlements and reduced stress during challenging times.