Beginners in insurance claim management should focus on understanding fundamentals like process steps and policy coverage. Promptly report incidents, gather evidence (photos, statements), and get estimates from reputable providers. Regular vehicle maintenance checks prevent costly repairs. Effective management involves thorough documentation and knowledge of covered/excluded items.

Unsure where to begin with insurance claim management? This comprehensive beginner’s guide breaks down the process into understandable steps. From grasping insurance claim basics to navigating the claims process in detail, this article equips you with essential knowledge. Learn how to maximize your compensation and employ effective prevention strategies. By the end, you’ll be confident in managing insurance claims like a pro.

- Understanding Insurance Claim Basics

- Navigating the Claims Process Step-by-Step

- Maximizing Your Compensation and Prevention Strategies

Understanding Insurance Claim Basics

When it comes to insurance claim management, understanding the fundamentals is a crucial first step for any beginner. An insurance claim is essentially a formal request made by a policyholder to their insurer for financial compensation or reimbursement after experiencing a covered loss or damage. This process involves several key players, including the policyholder, insurance company representatives, adjusters, and in many cases, specialized service providers like auto body shops or collision repair centers.

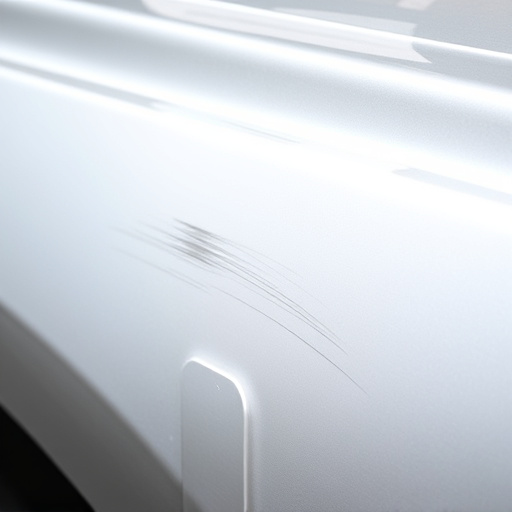

In the context of insurance claim management, knowing how to navigate this process is vital for ensuring timely compensation and a fair outcome. For instance, if you’ve suffered damage to your vehicle due to a collision (and require services like car dent repair or even more extensive collision repair), understanding what your policy covers and how to document the incident is essential. This includes gathering evidence, such as photographs of the damage, and providing accurate information about the circumstances surrounding the claim.

Navigating the Claims Process Step-by-Step

Navigating the claims process can seem daunting, but understanding each step is key to efficient insurance claim management. It begins with reporting the incident to your insurance company as soon as possible. This prompt action ensures a smoother process and allows for immediate attention to any damages. After filing your report, you’ll receive an assignment number, which acts as a reference point for all future communications related to your claim.

Next, gather all necessary information about the incident: details of the other party involved, witness statements, photographs of damage (if applicable, such as in a car repair shop scenario), and any medical records if it’s a personal injury claim. This documentation is crucial when preparing your claim. For instance, if you require collision repair services for your vehicle, ensure that estimates from reputable auto collision centers are included to support your claim for compensation towards the repair costs.

Maximizing Your Compensation and Prevention Strategies

To maximize your compensation when dealing with insurance claim management, it’s crucial to understand your policy and the process thoroughly. Familiarize yourself with the terms and conditions to ensure you’re aware of what’s covered and what isn’t. Gather all necessary documentation, including photos, estimates for repairs, and medical bills, as these will be vital in supporting your claim. Early preparation can significantly enhance your chances of receiving fair compensation.

Prevention strategies play a pivotal role in insurance claim management. Regular maintenance checks on your vehicle can help prevent minor issues from turning into major, costly repairs. Keeping detailed records of service histories and ensuring timely fixes for any warning signs can save you from hefty out-of-pocket expenses, including those for collision center visits or car body repair services. Remember, a well-maintained vehicle is less likely to require extensive and expensive repairs down the line.

Insurance claim management is a crucial skill for anyone looking to navigate the complexities of the claims process effectively. By understanding the basics, following a structured approach, and employing strategies to maximize compensation, beginners can confidently manage their insurance claims. Remember, proactive prevention measures are key to minimizing future issues, ensuring a smoother experience in the world of insurance claim management.