Meticulous documentation in insurance claim management streamlines processes from minor repairs to complex automotive body work, reducing errors and disputes. It provides clear evidence, context, and structured communication for all stakeholders, speeding up resolutions and improving efficiency for both insurers and policyholders. This includes detailed recording of initial assessments, repair work, parts used, and final inspections to achieve fair outcomes in complex cases.

Clear documentation is paramount in insurance claim management, acting as a cornerstone for efficient processes and accurate outcomes. This article delves into three key reasons why detailed, well-organized records are essential: streamlining claims handling, reducing errors, and facilitating dispute resolution. By examining these aspects, we highlight how clear documentation enhances the entire insurance claim management lifecycle, ensuring fairness, transparency, and timely settlements.

- Streamlining Processes: Clear Docs Simplify Claims Handling

- Enhancing Accuracy: Documented Details Reduce Errors in Claims

- Efficient Dispute Resolution: Well-Defined Records Facilitate Appeals

Streamlining Processes: Clear Docs Simplify Claims Handling

In the realm of insurance claim management, clear and concise documentation serves as a powerful tool for streamlining processes. When it comes to handling claims, whether it’s for hail damage repair on vehicles or managing complex automotive body shop restorations, having well-documented records simplifies the entire process. Insurers and adjusters can quickly access relevant information, ensuring efficient claim assessment and evaluation. This clarity in documentation saves time, reduces potential errors, and minimizes disputes that may arise from ambiguous details.

By promoting standardized procedures, clear documentation enables a more structured approach to insurance claim management. It facilitates smoother communication between stakeholders, including policyholders, insurers, and repair shops. For instance, when an automotive repair is required due to damage, detailed documentation can outline the extent of the work needed, ensuring that both parties are on the same page. This clarity is pivotal in fostering trust and ensuring a faster resolution for all involved, leaving a positive impact on overall claim management efficiency.

Enhancing Accuracy: Documented Details Reduce Errors in Claims

In the intricate world of insurance claim management, clear and concise documentation stands as a cornerstone of efficient processes. When it comes to handling claims for incidents like fender benders or scratch repairs in a car body shop, every detail matters. Well-documented records ensure that all aspects of the claim are accurately captured and processed, minimizing errors and potential disputes.

Accurate documentation acts as a safety net by providing concrete evidence and context. For instance, detailed descriptions of vehicle damage, repair estimates from certified mechanics, and step-by-step accounts of the incident reduce the likelihood of miscommunication or fraudulent claims. This, in turn, streamlines the claim management process, benefiting both insurance providers and policyholders by expediting payments and repairs for car body shop services.

Efficient Dispute Resolution: Well-Defined Records Facilitate Appeals

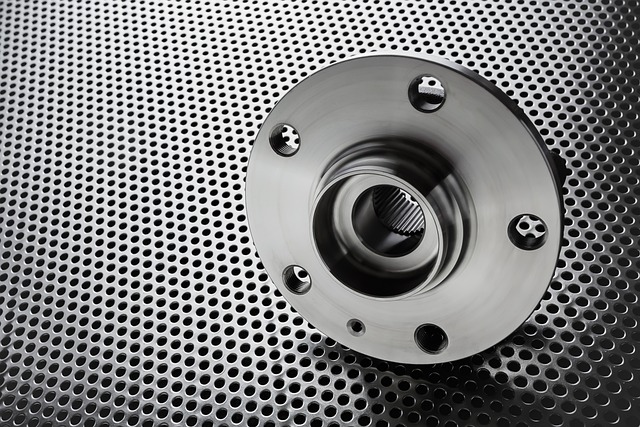

In the realm of insurance claim management, clear and well-defined documentation plays a pivotal role in efficient dispute resolution. When it comes to handling claims for vehicle dent repairs, tire services, or auto body repair, having comprehensive records facilitates the entire process. This is because records provide a detailed account of events, damages, and agreements made between the insured and the insurance provider. Such transparency helps streamline appeals, ensuring that any disagreements or discrepancies can be swiftly addressed and resolved.

By maintaining meticulous documentation, claim managers can navigate through complex cases with ease. This includes documenting initial assessments, work performed, parts used (such as those for vehicle dent repair), and final inspections. These records not only support the authenticity of claims but also enable fair comparisons when verifying the quality of repairs (e.g., auto body repair). Efficient dispute resolution is thus achieved through the seamless integration of clear documentation into insurance claim management practices.

Clear and concise documentation is paramount in insurance claim management, streamlining processes, enhancing accuracy, and efficiently resolving disputes. By meticulously recording details, stakeholders can navigate complex claims scenarios with greater ease, ensuring fair outcomes for all involved parties. Well-defined records not only facilitate appeals but also serve as a robust foundation for future reference, thereby revolutionizing the traditional claims process.